Turbotax calculator for f1 student software#

If you are still confused after that contact the software provider for support. If you are concerned, then use the software linked above to get an answer. It is possible your friend also filed using the incorrect status Resident vs. That happens, there are many reasons it could happen. Have them follow the procedure above and file their own taxes separately. You need to file your taxes based on the above and file an 8843 for each dependent. You can only use a 1098-T if you are a Resident for Tax Purposes. It is 100% seperate from your immigration status and does not, can not, and has not granted you any sort of permanent residency in any way shape or form.

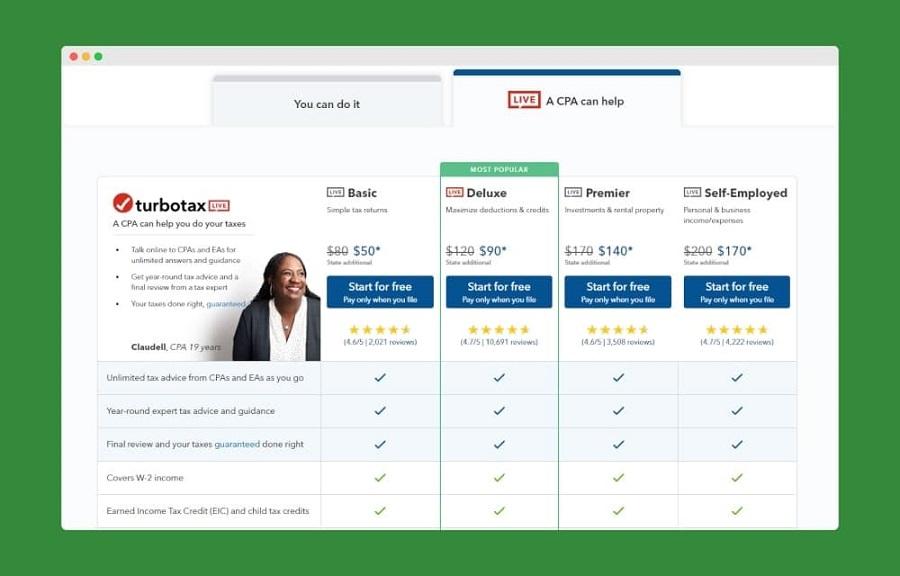

That said, you also have more tax liability now compared to before. You are just now given more flexibility with your taxes and qualify for some additional tax benefits you didn't otherwise qualify for before. You are not an actual resident of the US and your immigration status has not changed. That's why it says, "Resident for tax purposes". I was deemed a "Resident for Tax Purposes" am I now eligible for permanent resident benefits? If you are deemed a resident for tax purposes you can use any other tax software designed for an American. If you want another option there is Glacier tax Prep Both of these companies specialize in Non-Resident Taxes. If you are deemed a non-resident for tax purposes and you like their software you can continue to use it for your taxes and pay them for convenience. You do not need to pay to use this portion of their software. You can find the questionnaire hereĪlternatively, you can go to sign up for their program and use the tax determination questionnaire at the beginning of their software. Yes, but you need to find out if you are a "Resident for Tax Purposes" or a "Non-Resident For Tax Purposes". If you did not work then you need to file a form 8843 That is all that you must do if you otherwise did not work or receive taxable payments.Ĭan I use Turbo tax or another program to file my taxes?

If this is you continue on to the next question. If you worked in 2020 you received tax documents from your employer (likely a W2 or a 1099 of some sort). Yes, all F-1 visa holders regardless of employment or not need to file their taxes. Introduction to Residency Under U.S.No, tax filing now is for the calendar year 2020 and started February 12, 2021, and ends April 15, 2021.Publication 501, Exemptions, Standard Deduction and Filing Information.The Taxation Of Capital Gains Of Nonresident Alien Students, Scholars and Employees of Foreign Governments.Nonresident Aliens - Exclusions from Income.Nonresident Alien Students and the Tax Home Concept.Characterization of Income of Nonresident Aliens.Certain Types of Nontaxable Interest Income.Nonresident Aliens and the Accountable Plan Rules.Withholding Federal Income Tax on Scholarships, Fellowships, and Grants Paid to Aliens.Withholding Certificate Forms Under I.R.C.Federal Income Tax Withholding and Reporting on Other Kinds of U.S.Federal Income Tax Reporting and Withholding on Wages Paid to Aliens.Alien Liability for Social Security and Medicare Taxes of Foreign Teachers, Foreign Researchers, and Other Foreign Professionals.

Turbotax calculator for f1 student free#

0 kommentar(er)

0 kommentar(er)